vermont income tax rate 2021

This means that different portions of your taxable income may be taxed at different rates. 2017-2018 Income Tax Withholding Instructions Tables and Charts.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

This 2021 Vermont Tax Expenditure Report is a continuing effort to catalogue all exemptions exclusions deductions credits preferential rates or deferral of liability as defined in 32 VSA.

. Find your gross income. Your average tax rate is. For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US.

A financial advisor in Vermont can help you understand how taxes fit into your overall financial goals. Tue 12212021 - 1200. Tax Year 2021 Personal Income Tax - VT Rate Schedules.

335 percent if your taxable income is 1 to 40950 and youre filing single or if your taxable income is 1 to 68400 and youre married filing jointly. Tax Rate Filing Status Income Range Taxes Due 335 Single 0 to 40950 335 of Income MFS 0 to 34200 335 of Income MFJ 0 to 68400 335 of Income HOH 0 to 54850 335 of Income 660 Single 40950 to 75000. Check the 2021 Vermont state tax rate and the rules to calculate state income tax.

312 a applicable to the states major tax sources and provide. Detailed Vermont state income tax rates and brackets are available on this page. For example a single.

Property presences in Vermont that also export most of their sales mainly manufacturing. 2017 VT Tax Tables. 2021 federal capital gains tax rates.

Tax Rates and Charts. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Enter 3189 on Form IN-111 Line 8.

Tax Rate 0. Download or print the 2021 Vermont Tax Rate Schedules Income Tax Rate Schedules for FREE from the Vermont Department of Taxes. 34 rows Order Paper Forms.

Tax Rates and Charts. Section 1326 of the Vermont Unemployment Compensation Law provides five different rate schedules each with twenty-one tax rates. Vermont Income Tax Calculator 2021 If you make 160500 a year living in the region of Vermont USA you will be taxed 38632.

This booklet includes forms and instructions for. Meanwhile total state and local sales taxes range from 6 to 7. VT Taxable Income is 82000 Form IN-111 Line 7.

2016 VT Rate Schedules and Tax Tables. 2021 Vermont Tax Rate Schedules Example. 2021 VT Tax Tables.

2021 Vermont Income Tax Return Booklet. They vary based on your filing status and taxable income. Vermonts average education income tax rate would presumably be higher than any of these states average local rates.

The tax schedules are designed so that Rate Schedule 3 provides an equilibrium of funding across the. Vermont has four state income tax brackets for the 2021 tax year. Thu 12162021 - 1200.

The Vermont tax rate is unchanged from last year however the income tax brackets increased due to the annual. Multiply the result 7000 by 66. 2021 Income Tax Return Booklet.

The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. Vermont Income Tax Calculator 2021 If you make 70000 a year living in the region of Vermont USA you will be taxed 10996. 2021 Vermont Tax Tables.

Individuals earning 200-500K pay a higher marginal rate in Vermont 875 than in any other state. Find your pretax deductions including 401K flexible account contributions. Tue 01252022 - 1200.

Revenues are expected to decline because a significant portion of Vermont corporate tax revenues are derived from these firms. There are a total of eleven states with higher. Your average tax rate is.

Your 2021 Tax Bracket to See Whats Been Adjusted. Vermont collects a state corporate income tax at a maximum marginal tax rate of 8500 spread across three tax brackets. Tax Rates and Charts.

2022 Interest Rate Memo. Ad Compare Your 2022 Tax Bracket vs. 2017-2018 Income Tax Withholding Instructions Tables and Charts.

Vermont Tax Brackets for Tax Year 2021 2021 Tax Brackets and Income ranges will be listed here as they become available. Filing Status is Married Filing Jointly. Base Tax is 2727.

Subtract 75000 from 82000. IN-111 IN-112 IN-113 IN-116 HS-122 RCC-146 HI-144. Add this amount 462 to Base Tax 2727 for Vermont Tax of 3189.

The tables below show marginal tax rates. These firms tend to be multi-state or multinational Vermont Gross Receipts Minimum Rate Under 100k 250 100k-1 million 500. 2017 VT Rate Schedules.

2021 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Income tax rate comparison2 Vermonts existing top marginal rate 875 is one of the ten highest in the nation. How to Calculate 2021 Vermont State Income Tax by Using State Income Tax Table.

Find your income exemptions. 2022 Income Tax Withholding Instructions Tables and Charts. 2019 Income Tax Withholding Instructions Tables and Charts.

Discover Helpful Information and Resources on Taxes From AARP. The appropriate schedule is determined by a special formula in the Vermont Unemployment Compensation Law.

The States Where People Are Burdened With The Highest Taxes Zippia

State Income Tax Rates Highest Lowest 2021 Changes

Vermont Income Tax Calculator Smartasset

Vermont Income Tax Calculator Smartasset

Personal Income Tax Department Of Taxes

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Vermont Estate Tax Everything You Need To Know Smartasset

Vermont Tax Forms And Instructions For 2021 Form In 111

States With Highest And Lowest Sales Tax Rates

Vermont Income Tax Calculator Smartasset

How Is Tax Liability Calculated Common Tax Questions Answered

2022 Eligibility Tables Vermont Health Connect

The Most And Least Tax Friendly Us States

Vermont Income Tax Brackets 2020

State Corporate Income Tax Rates And Brackets Tax Foundation

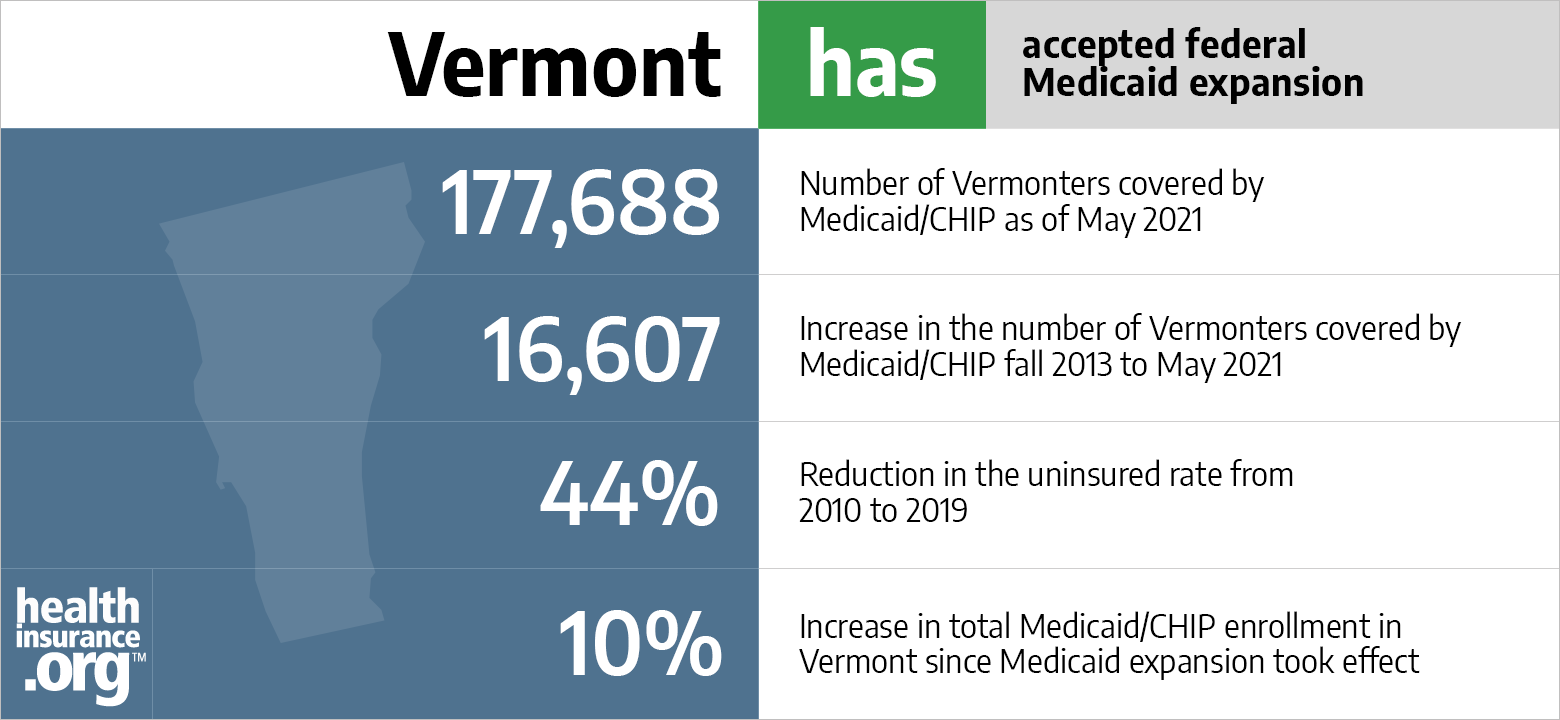

Aca Medicaid Expansion In Vermont Updated 2022 Guide Healthinsurance Org

How Is Tax Liability Calculated Common Tax Questions Answered

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective